Footprint’s investment portfolio is 100% values and mission aligned.

Footprint’s portfolio is allocated to investments that incorporate social and/or environmental considerations and span multiple investment philosophies, each achieving impact in different ways across 4 categories: (1) sustainable, (2) positive engagement, (3) thematic, and (4) catalytic.

-

Sustainable investments incorporate environmental, social, and/or governance considerations into the investment process. In some cases, these investments apply client-directed screens that exclude specific industries or companies that do not align with our values while emphasizing those that do.

Examples from our portfolio include Aperio Group and Forefront Analytics.

-

Positive engagement investments include those where the investment manager actively engages portfolio companies to encourage better environmental, social, or governance practices. Managers engage companies via letter writing, public campaigns, proxy votes, shareholder proposals, and dialogue with management. Frequent topics of engagement include climate transparency and action, workplace diversity, pay equity, and human rights.

Examples from our portfolio include Impact World Equity Fund and Ownership Capital.

-

Thematic investments prioritize financial returns while focusing on two themes:

Climate Sustainability includes Decarbonization Tech (e.g., renewables, materials, mobility, etc.) and Nature-Based Solutions (e.g., timber, agriculture, soil, water, etc.).

Inclusive Innovation includes solutions that improve access, affordability, and capital flows across housing, education, health, financial inclusion, job creation.

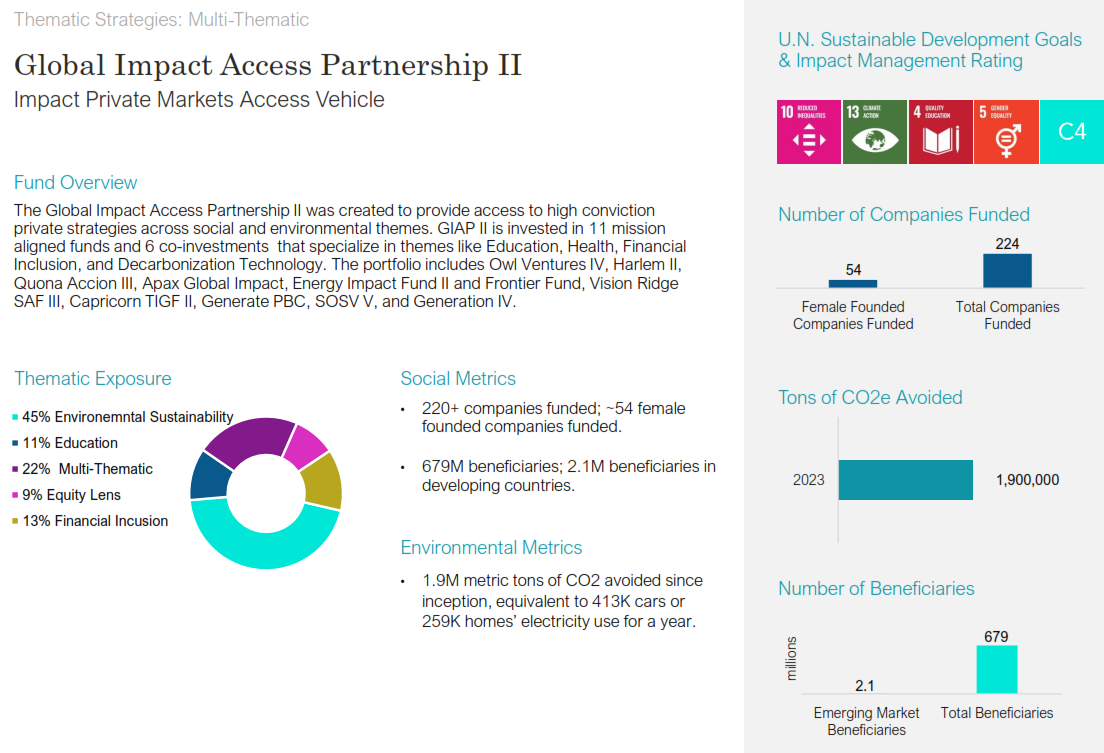

Examples from our portfolio include Generate, Greenbacker, Jonathan Rose Affordable Housing, Global Impact Access Partnership, and Harlem Capital.

-

These investments prioritize social and/or environmental impact with financial return being a secondary goal. Catalytic investments span two themes:

Climate Sustainability includes Decarbonization Tech (e.g., renewables, energy efficiency, mobility, etc.) and Nature-Based Solutions (e.g., timber, agriculture, soil, water, etc.).

Inclusive Innovation includes solutions that improve access, affordability, and capital flows across housing, education, health, financial inclusion, job creation.

An example from our portfolio is the no-interest loan we made to local nonprofit LAUNCH to help with the down payment needed to purchase the Kitchen Incubator building.

Measuring Impact

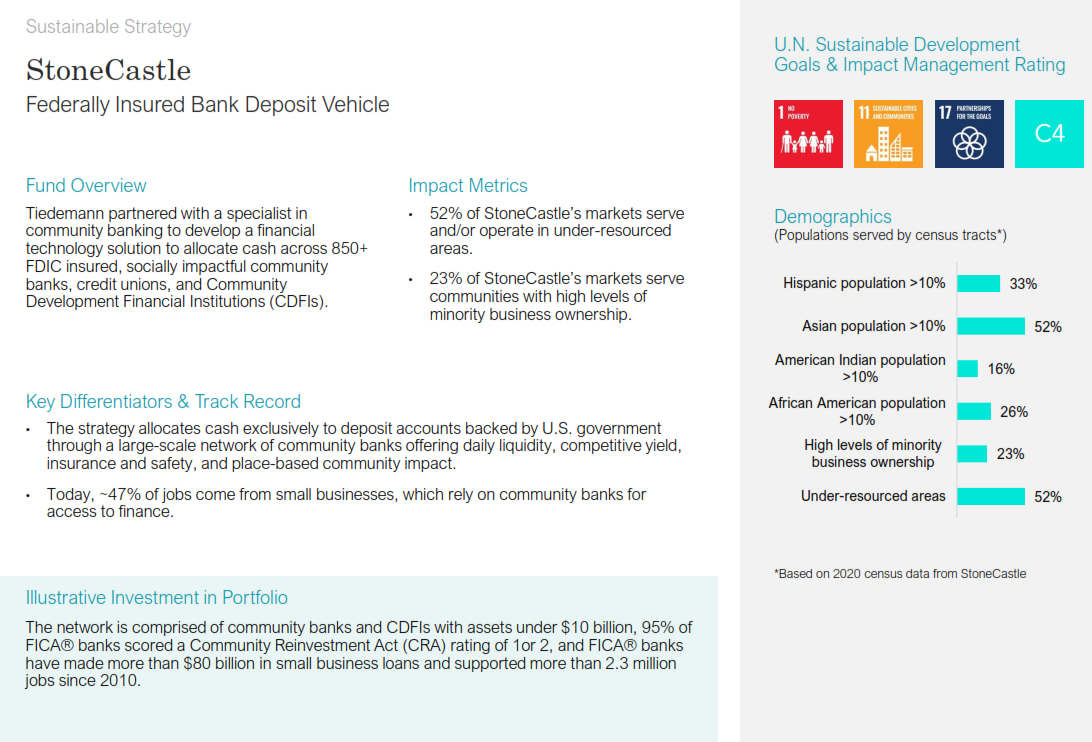

Our investment advisors use the Impact Management Project to evaluate the impact performance of our investments against the U.N. Sustainable Development Goals.

Examples of Values and Mission Aligned Investments in Footprint’s Portfolio

Source: Annual Impact Report prepared by AlTi Tiedemann Global for Footprint Foundation.